Click here to determine your Leadership Protection Quotient (PQ) & get a free copy of The Science of Protection book

Click here to determine your Leadership Protection Quotient (PQ) & get a free copy of The Science of Protection book

THE CEO PROBLEM

Data from a 2022 Alix Partners Disruption Index reports 58% of CEOs are replaced within two years

of a VC investment & 73% replaced over the life time of an investment.

CBS reported CEOs Quitting At Record Pace indicates many CEOs struggle with having the

leadership capacity to protect themselves, performance & progress of their companies.

Many of these CEOs feel burnout, miss out on time with family, and are running on empty due to

under the pump 24/7 pressure of problems, challenges, issues, and increasing list of priorities,

on top of the constant demand of stakeholders to improve performance.

THE CEO PROBLEM

Data from a 2022 Alix Partners Disruption Index reports 58% of CEOs are replaced within two years of a VC investment & 73% replaced over

the life time of an investment.

THE NEW MAVERICKS

CEO SOLUTION

CEO SOLUTION

New Mavericks time & field proven proprietary CEO Breakthrough Protection program enables top 1% CEOs to get 3-4x faster buy-in to deals & objectives guaranteed thereby enhancing & protecting the value of their company, remuneration & health to have more presence & time for family.

We bring top CEOs to another level of even more leadership capacity to have the right strategic insights to make the right decisions that create the right business experience for themselves, team and families, while protecting their health from absorbing the pressure and stress of problems and challenges, so they better respond rather than react to these.

We’ve enabled over 100 CEOs & executives to do this and it has resulted in tens of billions in revenue & stock value appreciation in the last decade by enabling them to get major deals with the likes of:

Hyundai-Kia, Siemens, General Electric, FedX, IMG, McDonalds, Chemist Warehouse, Portfolio Partners, Harcourts, Top govt contractors, Governments, English Premiership League, SANZAAR Rugby, Top US College Sporting Conferences, IGV - Top China eSports company, & Cricket Australia, who has over 1 billion fans worldwide.

THE NEW MAVERICKS CEO SOLUTION

New Mavericks time & field proven proprietary CEO Breakthrough Protection program enables

top 1% CEOs to get 3-4x faster buy-in to deals & objectives to enhance & protect company progress, valuation & remuneration while having mental, emotional & physical health to enjoy more presence & time with family.

Our vision and mission is to enable billionaires, founders, top CEOs & high performers to quickly evolve their leadership awareness, capacity & psychology to the highest level to have the right strategic insights to make the right decisions that creates the right business experience for themselves, team and families, while protecting their mental, emotional & physical health from absorbing the pressure and stress of problems and challenges.

We’ve enabled over 100 leaders to do this and it has resulted in tens of billions in revenue & stock value appreciation in the last decade, supporting & protecting them in their process of getting major deals with the likes of:

Hyundai-Kia, Siemens, General Electric, FedX, IMG, McDonalds, Chemist Warehouse, Life Health Care, Portfolio Partners, Harcourts, Top govt contractors, Governments, English Premiership League, SANZAAR Rugby, Top US College Sporting Conferences, IGV - Top China eSports company, and Cricket Australia, which has 1 billion fans.

This program has a scientifically validated approach through over 600 studies

in developing CEOs & executives to their highest potential & performance.

We do what is best for the companies we serve!

FREE CEO Breakthrough Masterclass

Discover How Top 1% CEOs Breakthrough Obstacles & Stress to Get 3-4x Faster Buy-In to Bigger Deals & Objectives

FREE CEO Breakthrough Masterclass

Discover How Top 1% CEOs Breakthrough Obstacles & Stress to Get 3-4x Faster Buy-In to Bigger Deals & Objectives

* For CEOs with revenues over $10 million only

For Immediate CEO Breakthrough Protection Support

To remove uncertainty, stress and obstacles like:

- deals that aren't progressing as fast as you'd like

- stagnant or bottlenecked P&L performance

- lack of cohesion with team, board or investors delaying execution

- not attracting the right talent and people

- lack of clarity and stress with difficult decisions

Call: +1-323-742-2225 or email support@newmavericks.com

What we do, How we work, Why we're great, Who we are & Top client experiences.

For Immediate CEO Breakthrough Protection Support

To remove uncertainty, stress & obstacles like:

- deals not progressing as fast as you'd like

- stagnant P&L performance

- lack of cohesion with team, board or investors delaying execution

- not attracting the right talent and people

- lack of clarity & stress with difficult decisions

Call: +1-323-742-2225 or email support@newmavericks.com

What we do, How we work, Why we're great, Who we are & Top client experiences.

Client Experiences

Arafura Resources is the new significant player in the rare earths industry.

Their resource is essential for EV and cell phone manufacturing.

Linius Technologies is a leading player in hyper personalized video virtualization.

Their tech allows audiences to choose the exact video moments they wish

to see and instantly create personalized video compilations.

Cornwalls is a top 10 multi-disciplinary law firm in their market.

Levent also has many board directorships with top sporting & entertainment organizations.

Based on Interviews with 5 of our CEOs & Investors of Publicly Listed Companies

Client Experiences

Arafura Resources is the new significant player in the rare earths industry.

Their resource is essential for EV and

cell phone manufacturing.

Their resource is essential for EV and

cell phone manufacturing.

Linius Technologies is the new leading player in hyper personalization video virtualization.

Their tech allows audiences to choose the exact video moments they wish to see and instantly create personalized video compilations.

Cornwalls is a top 5 multi-disciplinary law firm in their market.

Levent also has many board directorships with top sporting & entertainment organizations.

Article

Based on Interviews with 5 of our CEOs & Investors of Publicly Listed Companies

Sign up to be a New Mavericks Insider & get The Science of Protection eBook FREE PLUS latest leadership insights!

Determine Your CEO Protection Quotient (PQ)

Determine Your CEO Protection Quotient (PQ)

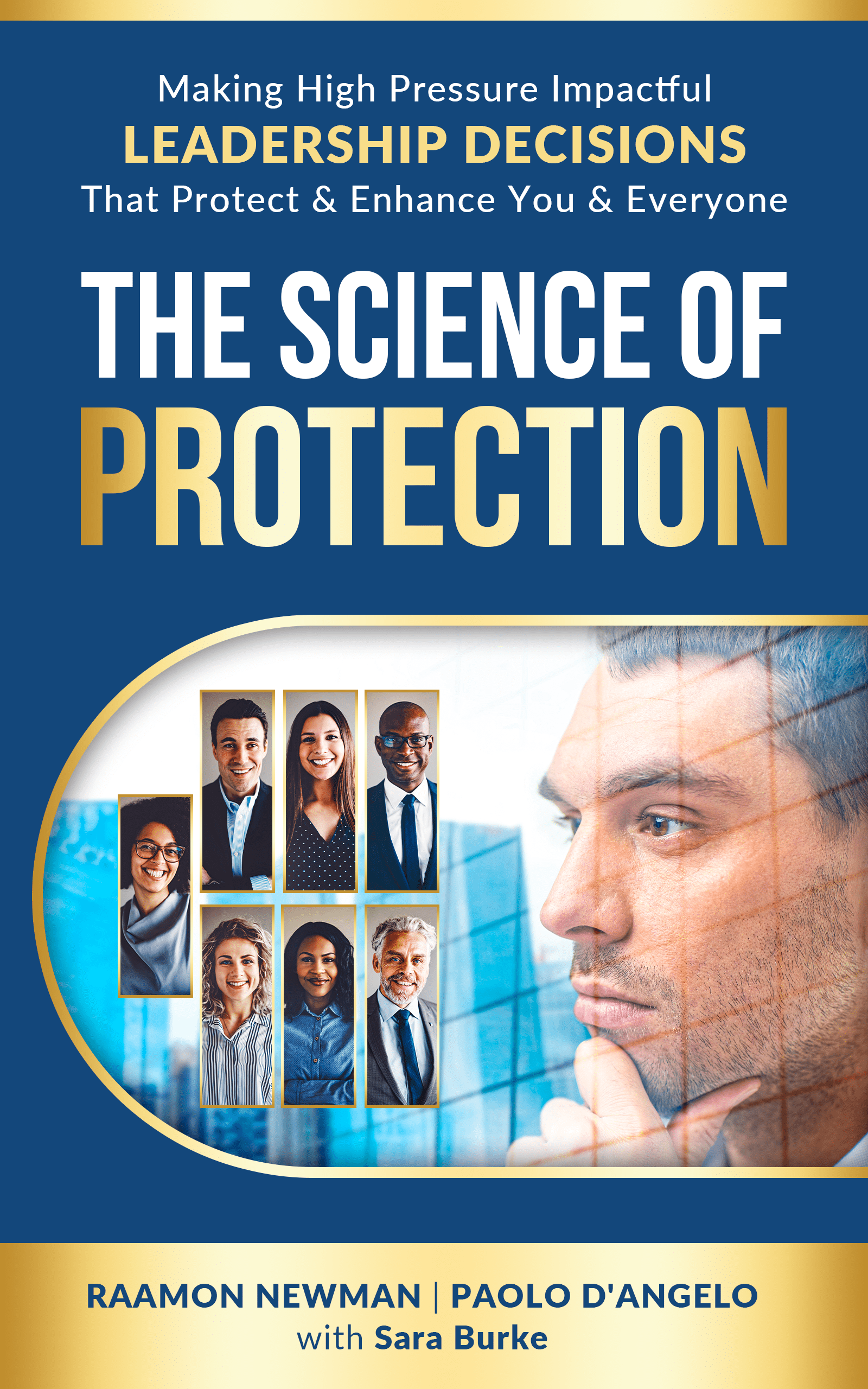

Protection is the New Fair Advantage in CEO Leadership

Make the Science of Protection the

basis of your CEO leadership development & performance to achieve as much as you want for

as long as you want with greater ease.

Paperback, Kindle & Audio versions available on Amazon

For wholesale orders contact:

support@newmavericks.com

Protection is the

New Fair Advantage

in CEO Leadership

in CEO Leadership

Make the Science of Protection

the basis of your CEO leadership development & performance to achieve as much as you want for as long as you want with ease

Paperback, Kindle & Audio versions available on Amazon

For wholesale orders contact: support@newmavericks.com

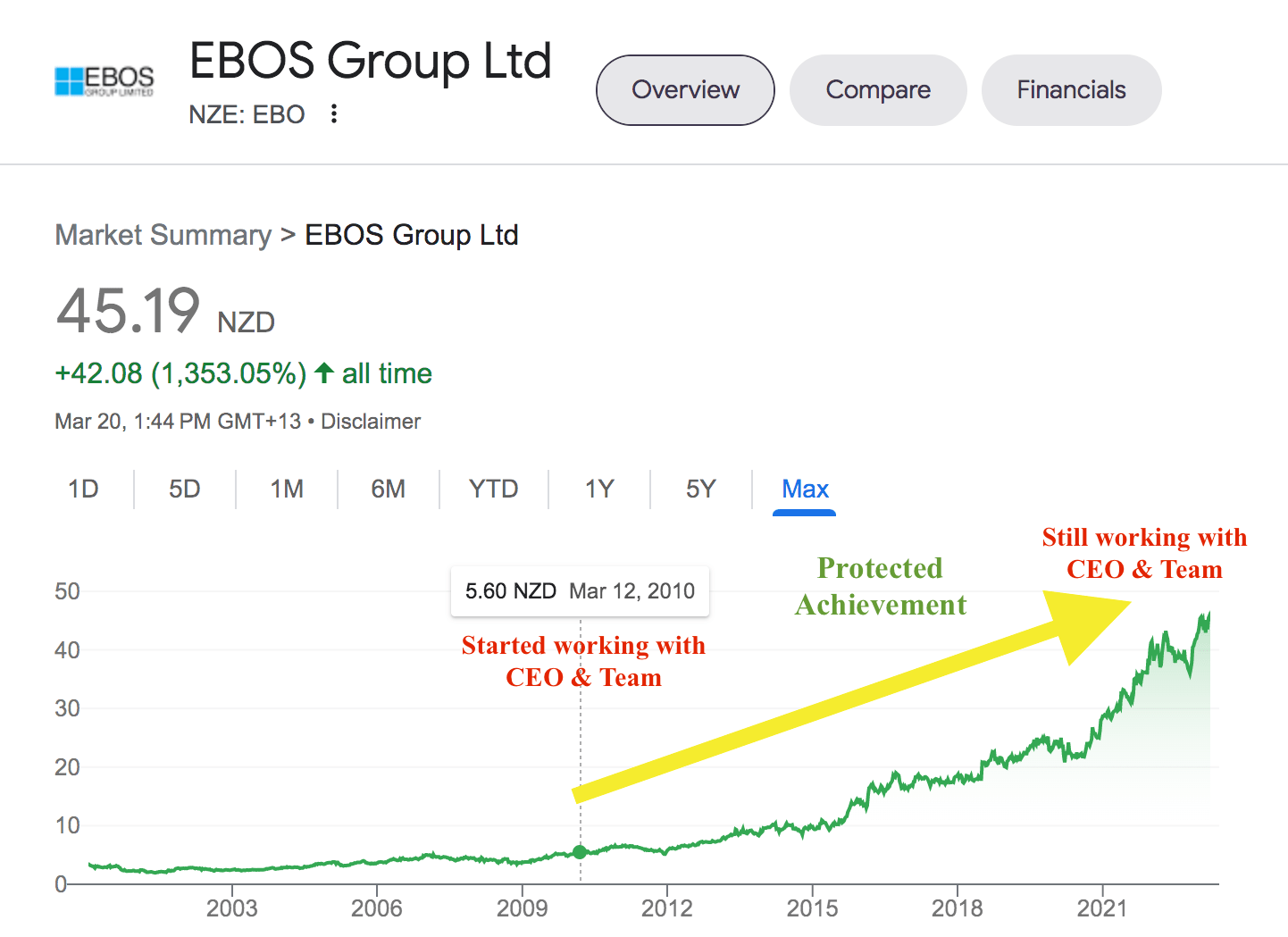

Creating Protected Achievement in Any Market

Hi, my name is Raamon Newman, and my business partner, Paolo D'Angelo, and I are glad you're here because we want to share how you can enjoy a protected advantage & achievement in any market when you develop your awareness to know what is truthful, evolutionary, right & correct, and act on it.

You naturally do this through protecting & enhancing your CEO leadership capacity & skill to make those high pressure impactful decisions that inspires full support to create maximum value for all stakeholders.

This is the experience we take full responsibility in creating with you.

Yes, you can in fact experience this, like our 10 year client below:

“Organizing the biggest deal in our corporate history involved long hours, tight time frames and multiple go / no-go hurdles & multiple possibilities for stress.

Despite this, I personally felt like I was the eye of the storm…all is calm and relaxed...as a result, the deal fell into place."

"If you’re leading a small, medium or large business in this age of exponential change, & want to be in tune with change and leading change rather than a victim of it, you’ve got to have at least one call with Paolo and Raamon to truly know the deeper value they bring in enhancing and protecting leader’s achievement and progress.

Their wisdom, insights, support, and value has made a profound difference in enhancing my experience as a leader in a very competitive tight margin industry and is something I haven’t found anywhere else.”

Mark Waller

Former Chairman & CEO

of EBOS Group

CEO of the Year 2010, New Zealand Business Hall of Fame 2019

Determine Your CEO Protection Quotient (PQ)

Creating Protected Achievement in Any Market

“Organizing the biggest deal in our corporate history involved long hours, tight time frames and multiple go / no-go hurdles & multiple possibilities for stress. Despite this, I personally felt like I was the eye of the storm…all is calm and relaxed...as a result,

the deal fell into place."

"If you’re leading a small, medium or large business in this age of exponential change, & want to be in tune with change and leading change rather than a victim of it, you’ve got to have at least one call with Paolo and Raamon to truly know the deeper value they bring in enhancing

and protecting leader’s achievement and progress.

Their wisdom, insights, support, and value has made a profound difference in enhancing my experience as a leader in a very competitive tight margin industry and is something

I haven’t found anywhere else.”

Mark Waller

Former Chairman & CEO of EBOS Group

New Zealand CEO of the Year 2010 & Business Hall of Fame 2019

Long term Protected Sustained Achievement & Progress

NEW MAVERICKS INTRODUCTION (audio)

How We Enhance & Protect Leaders & Their Achievement

Because of the consistently improving results our clients experience with us, most work with us for 5-10 years, we’re able to guarantee you significant progress towards your most important goal in the first 90 days of working with us.

NEW MAVERICKS INTRODUCTION (audio)

How We Enhance & Protect Leaders & Their Achievement

Because of the consistently improving results our clients experience with us, most work with us for 5-10 years, we’re able to guarantee you significant progress towards your most important goal in the first 90 days of working with us.

“There are plenty of people who think they’re so good they don’t need to listen to feedback and those are the people who ultimately make huge mistakes.”

“The key insight of a coach is they get you to believe you can do something that you can’t currently do today and when you screw up they guide you to that excellence.”

Eric Schmidt

Google CEO 2001 - 2011

Any person or team who has risen to the top in any field, and stayed there for a significant time, has always had a great coach, mentor, partner or advisor, someone behind the scenes supporting, guiding, optimizing & protecting them in their process.

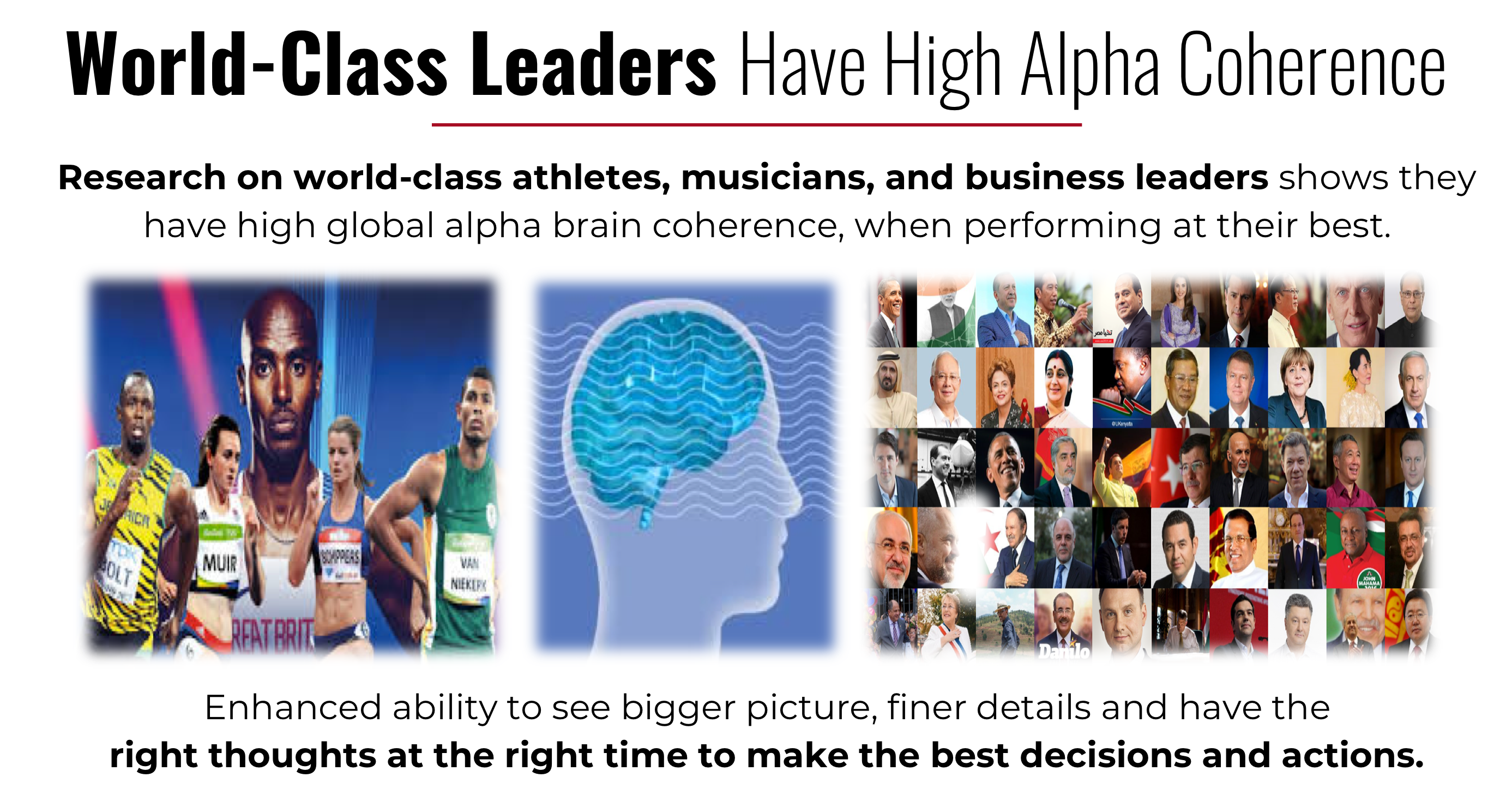

Because of the constant disruption the “age of acceleration” creates, leaders require a deeper level of support beyond just executive coaching and developing leadership skills.

Every self respecting leader requires and deserves wise advisors & partners

who exclusively help you work on developing yourself to be even more awake, alert, coherent and calm to:

1. Avert dangers, threats, problems and losses before they arise.

2. See opportunities and better possibilities as they arise.

3. Have maximum support, cohesion and cooperation from your team, board,

shareholders and marketplace for what you envision.

“There are plenty of people who think they’re so good they don’t need to listen

to feedback and those are the people who ultimately make huge mistakes.”

Our passionate noble purpose is enabling CEOs & executives of publicly listed companies expand their capacity, protection & support to fulfill their CEO leadership vision with ease and in good health in the

age of acceleration.

Because of the constant disruption the “age of acceleration” creates, leaders require

a deeper level of support beyond just CEO coaching and developing leadership skills.

Every self respecting leader requires and deserves wise advisors & partners

who exclusively help you work on developing your capacity to be even more

awake, alert, coherent and calm to:

1. Avert dangers, threats, problems and losses before they arise.

2. See opportunities and better possibilities as they arise.

3. Have maximum support, cohesion and cooperation from your team,

board, shareholders and marketplace for what you envision.

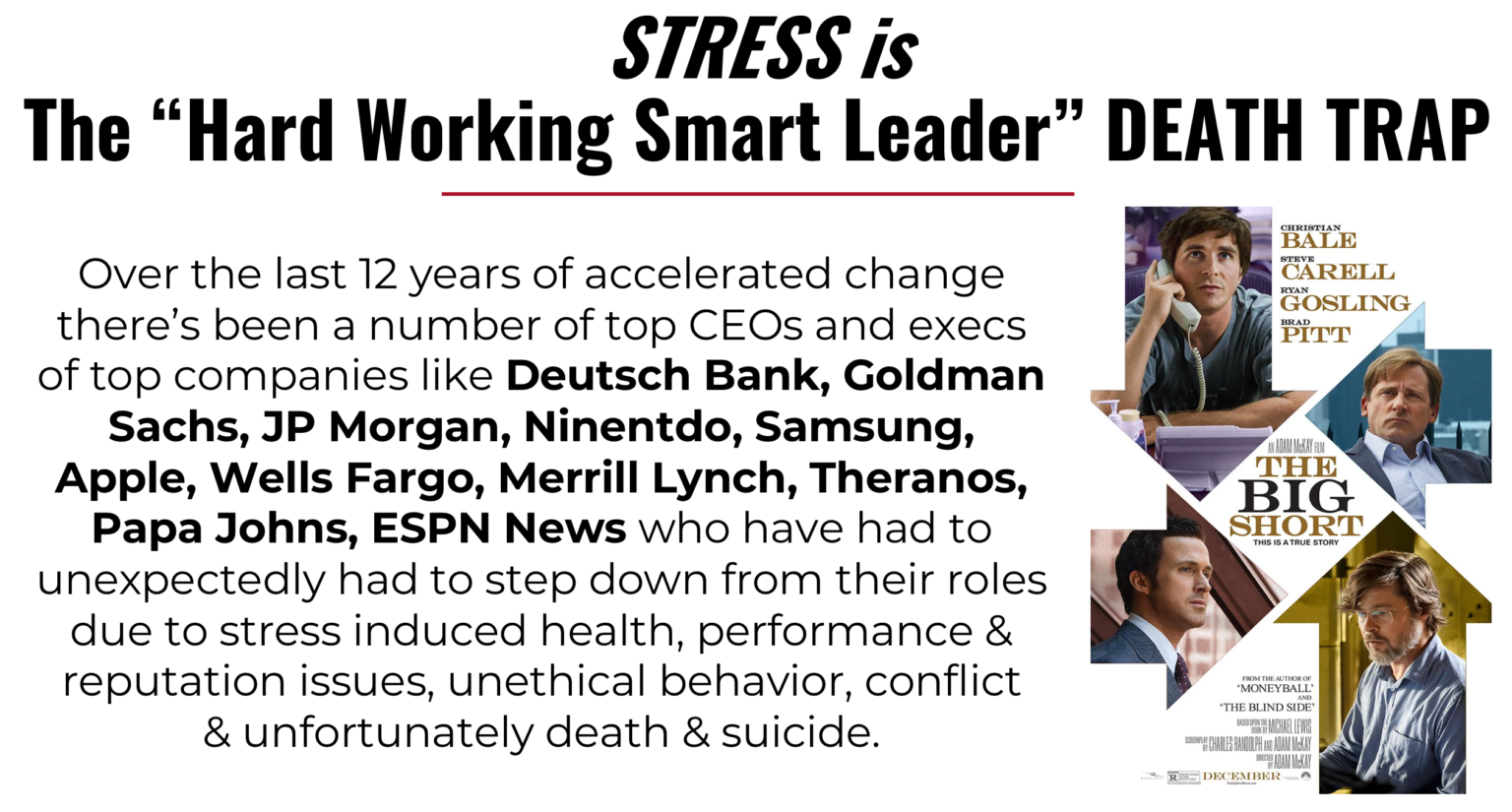

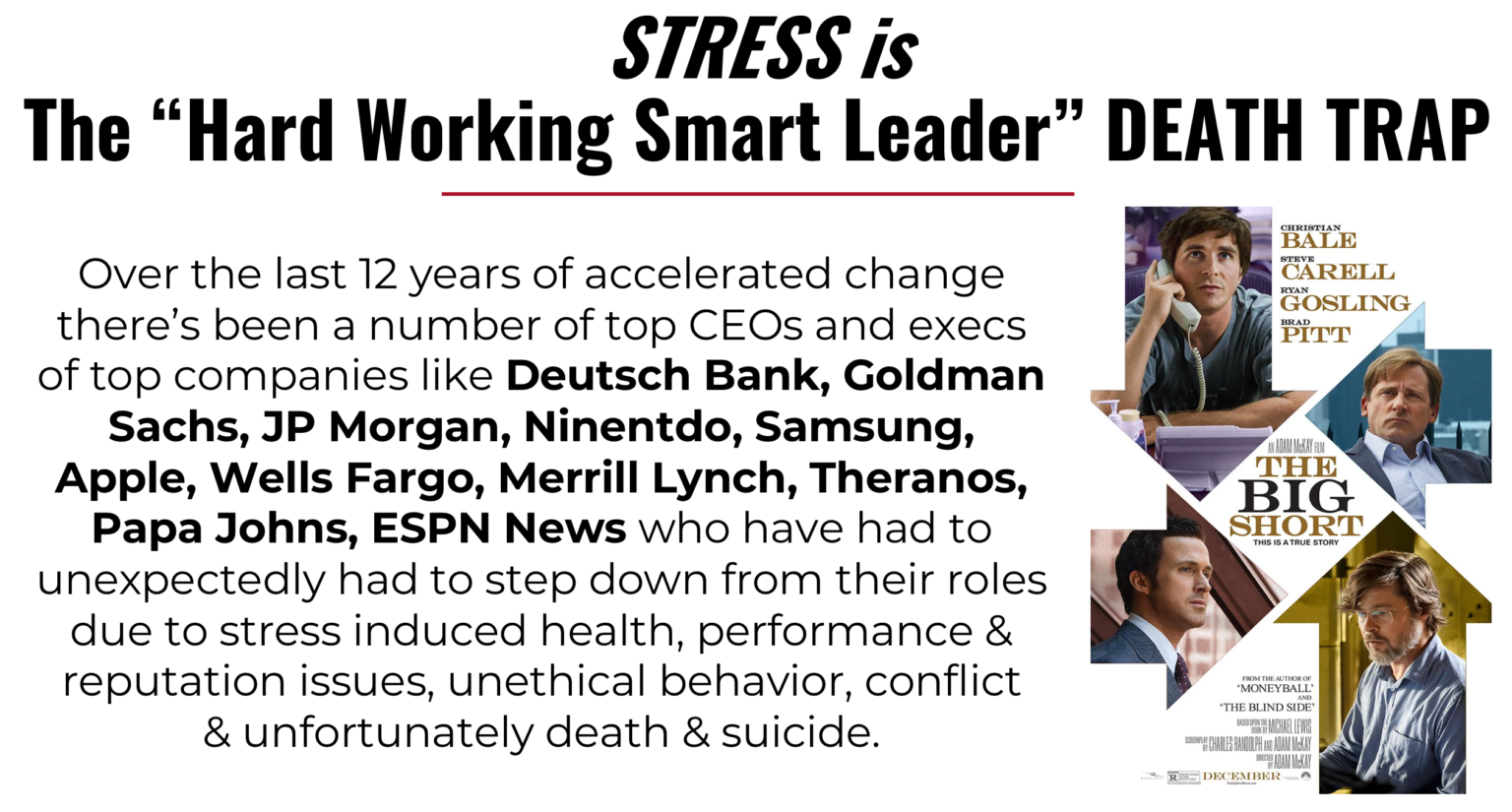

The Downside of Being a Top Leader

The Sad Downside Of Being A Top Leader

New York Times best selling author Thomas Friedman, author of Thank You for Being Late, labeled the years since 2007 the age of acceleration.

This is when the iPhone came out, microprocessing speed and globalization took a quantum leap.

Achievement has been incredible since then.

But it has come at a price.

Here are some recent unfortunate examples:

· While exercising during a family vacation, SurveyMonkey’s CEO Dave Goldberg died suddenly at the age of 47. Goldberg grew SurveyMonkey from 12 employees to 450 and to a $2 billion valuation. He was considered an irreplaceable talent.

· Steve Jobs was able to save Apple after he came back as CEO in 1996, but ironically was not able to save himself and passed away at the age of 56 from pancreatic cancer.

· Autumn Radtke, the 28-year-old CEO of Bitcoin exchange First Meta, jumped to her death in Singapore on 26 February 2014. On February 10th she posted a link to an essay entitled ‘The Psychological Price of Entrepreneurship’ and commented that everything had its price.

· Steven LeVoie founder of Arrowstream was shot by one of his own top lieutenants, at the age 54 in 2014.

· Michael Walsh, age 51 and CEO of Tenneco, succumbed to brain cancer.

· McDonald’s 60-year-old CEO, Jim Cantalupo, died of a heart attack in 2004. The board hastily replaced him with 43-year-old Charlie Bell, who died nine months later.

· Kate Spade built an iconic fashion brand only to pass at age 56 after suffering severe bouts of depression.

AVERTING LOSSES, DANGERS & THREATS BEFORE THEY ARISE

Many of these dangers and losses could have been averted before they arose had they had a deeper level of development, support and protection.

Stress causes these dangers and losses and costs US industry $300 billion a year due to absenteeism, employee turnover, diminished productivity, workers compensation & legal, medical & insurance costs.

According to the Gallup Wellbeing Index

45% of entrepreneurs report they’re stressed –

3% > other workers

Our time and field tested proven knowledge, techniques and technologies naturally, reliably and systematically enhance and sustain world-class brain functioning to go beyond stress so you don’t have to manage or avoid it.

45% of entrepreneurs report they’re stressed –

3% > other workers

Our time and field tested proven knowledge, techniques and technologies naturally, reliably and systematically enhance and sustain world-class brain functioning to go beyond stress so you don’t have to manage or avoid it.

New Maverick Leaders Easily Adapt To Change & Protect Themselves & Those They Lead By Handling The Positive & Negative Wisely

New York Times best selling author Thomas Friedman, author of Thank You for Being Late, labeled the years since 2007 the age of acceleration.

This is when the iPhone came out, microprocessing speed and globalization took a quantum leap.

Achievement has been incredible since then.

But it has come at a price.

Here are some unfortunate examples:

AVERTING LOSSES, DANGERS & THREATS BEFORE THEY ARISE

Many of these dangers and losses could have been averted before they arose had they had a deeper level of development, support and protection.

Stress causes these dangers and losses and costs US industry $300 billion a year due to absenteeism, employee turnover, diminished productivity, workers compensation & legal, medical & insurance costs.

According to the Gallup Wellbeing Index

45% of entrepreneurs report they’re stressed –

3% > other workers

Our time and field tested proven knowledge, techniques and technologies naturally, reliably and systematically enhance and sustain world-class brain functioning to go beyond stress so you don’t have to manage or avoid it.

45% of entrepreneurs report they’re stressed –

3% > other workers

Our time and field tested proven knowledge, techniques and technologies naturally, reliably and systematically enhance and sustain world-class brain functioning to go beyond stress so you don’t have to manage or avoid it.

New Maverick Leaders Easily adapt to change & Protect Themselves

& those they Lead by Developing their Capacity to Handle the Positive & Negative Wisely

WHAT WE DO

Determine Your CEO Protection Quotient (PQ)

WHAT WE DO

According to a Hay Group Study:

"Leaders had up to a 70% influence on the climate & culture of the company,

creating a 28% difference in the bottom line."

We help you have:

"Leaders had up to a 70% influence on the climate & culture of the company,

creating a 28% difference in the bottom line."

We help you have:

1. More CAPACITY by optimizing your mental performance & productivity

2. Greater PROTECTION of yourself, vision, team & achievements

3. Heighten SUPPORT from your environment, people and marketplace

Research reported in a Harvard Business Review article

“Companies with higher scores for their investment in human capital delivered stock returns that were five times higher than companies

with less emphasis.”

According to a Hay Group Study:

"Leaders had up to a 70% influence on the climate & culture of the company,

creating a 28% difference in the bottom line."

We help you have:

"Leaders had up to a 70% influence on the climate & culture of the company,

creating a 28% difference in the bottom line."

We help you have:

1. More CAPACITY by optimizing your mental performance & productivity

2. Greater PROTECTION of yourself, vision, team & achievements

3. Heighten SUPPORT from your environment, people and marketplace

Research reported in a Harvard Business Review article

“Companies with higher scores for their investment in human capital delivered stock returns that were five times higher than companies with less emphasis.”

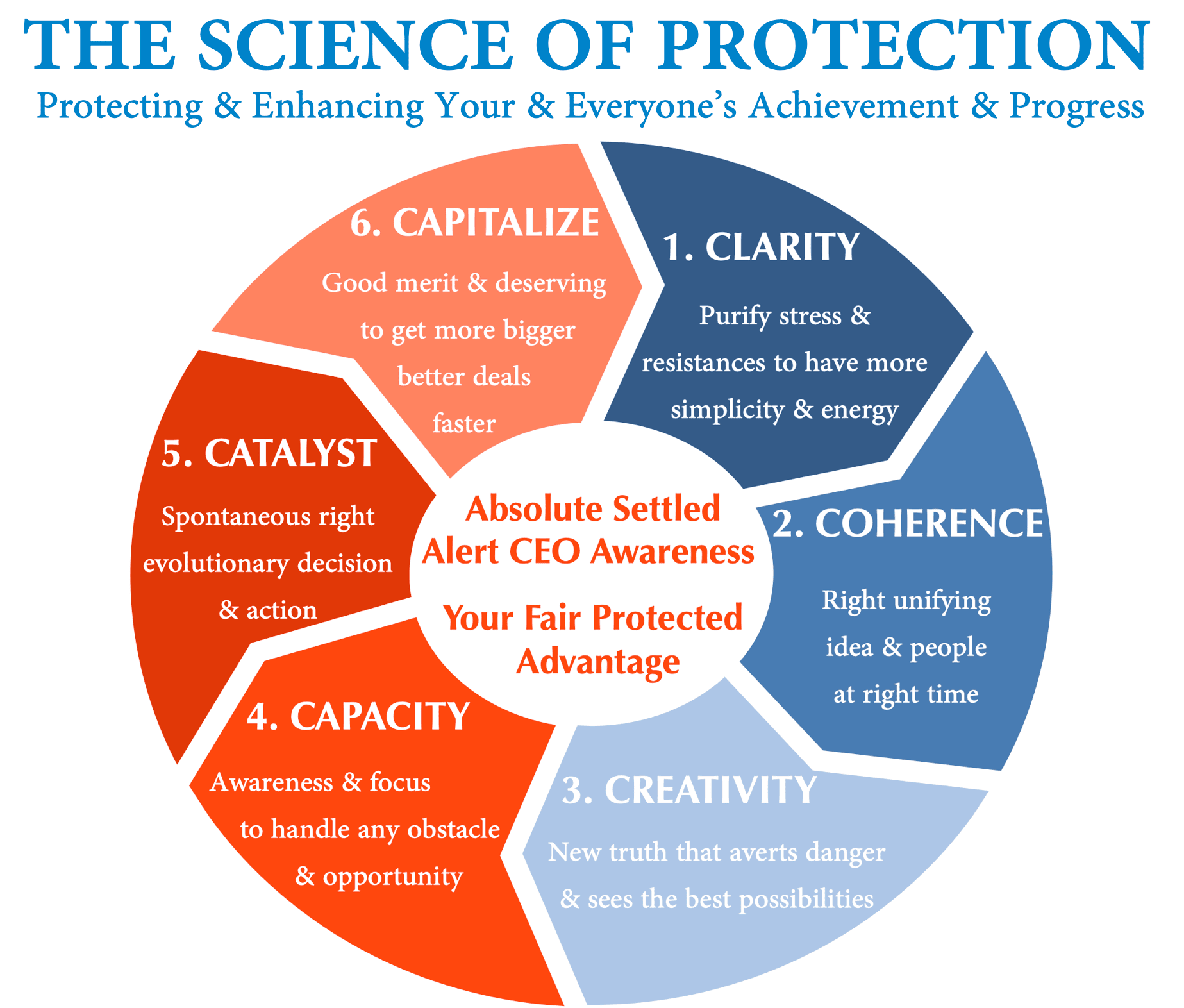

HOW WE DO THIS

HOW WE DO THIS

1. We implement our proprietary time and field tested proven Science of Protection, which activates world-class brain functioning to have even more clarity to think better and know what’s required to sustain breakthrough progress.

Science of Protection

2. This is executed through a highly personalized leadership development program based on the magnitude of your specific circumstances, vision, intentions & goals and is implemented in 2-3 hours per month through:

a) One hour phone calls every two weeks (with both myself and business partner)

b) 10-min on-demand calls for special situations that require extra attention.

c) Three techniques & technologies that help you quickly & easily make the best decisions, remove obstacles, & protect & enhance support for what you envision.

3. We start with a 30 day trust building period, so you experience the transformational value we deliver, then proceed based on your top priority & our guarantee and review after 90 days.

We implement our proprietary time and field tested proven Science of Protection, which gives leaders more clarity about what is going on and what is required to protect and sustain breakthrough progress.

This is executed through a highly personalized Leadership Breakthrough Protection program based on the magnitude of your specific circumstances, vision, intentions & goals.

This is implemented in 2-3 hours per month. Find out more on our Services page.

Find out more at ScienceOfProtection.org

Determine Your CEO Protection Quotient (PQ)

WHO THIS IS FOR

WHO THIS IS FOR

This for any leader or investor who:

1. Feels like they’ve plateaued and are tired of experiencing stagnate performance.

2. Wants more protection, support & breakthroughs for themselves, team, achievements & vision.

3. Wants to more easily overcome stresses, vices, negativity and obstacles.

4. You have an existing leadership role of at least 7-figure company.

5. You’re willing to implement the knowledge and support given to become a more enlightened leader.

This program will work for you when you meet and accept these five criteria.

Schedule a Discovery Call below:

For any CEO, executive or investor who:

1. Feels like they’ve plateaued and are tired of experiencing stagnate performance.

2. Wants more protection, support & breakthroughs for themselves, team, achievements & vision.

3. Wants to more easily overcome stresses, vices, negativity and obstacles.

4. You have an existing leadership role of at least 7-figure company.

5. You’re willing to implement the knowledge and support given to become a more enlightened leader.

This program will work for you when you meet and accept these five criteria.

Schedule a Discovery Call below:

Go Beyond Being Stagnate or Stuck to Superfluid Progress

Have Even More Capacity to For Relevant Strategic Insights

Lead With Even More Clarity, Coherence & Creativity

Go Beyond Being Stagnate or Stuck to Superfluid Progress

Have Even More Capacity to Have Relevant Strategic Insights

Lead From a Place of Even Greater Clarity, Coherence & Creativity

The Core Benefits Working With Us

The Core Benefits Working With Us

Working with us you'll experience more invincibility with your health, wealth, happiness, relationships and reputation enabling you to:

1. Have less stress and resistance to enhancing & protecting your company’s top & bottom lines, leading to higher remuneration increases.

2. A shield of protection around your decision making to avert problems, obstacles, losses, threats & disruptions before they arise or quickly transform them into opportunities when they do.

3. A clearer vision that you fully own, believe and trust that will increase engagement, coordination and support from your team and market, enabling you to achieve more doing less.

Transforming Pains Into New Maverick Leadership

Leadership Pain

Confused about why things aren't working

Being defensive

Feeling fatigued, stressed & tired

External and internal distractions

Feeling a lack of support and looking over your shoulder all the time

Transforms to

New Maverick Leadership

Greater trust & belief in yourself

Seeing new possibilities to lead change

Abundant energy to do what is required

Clear focus on what moves the needle

Cohesive engaged team who have your back

1. More protection of your health, wealth, relationships & reputation.

2. Less stress and resistance to enhancing & protecting

your company’s top & bottom lines.

3. Enhanced high pressure decision making ability to avert problems, obstacles, losses, threats & disruptions before they arise

and see opportunities as they arrive.

4. A clearer vision that you fully own, believe and trust that will increase engagement, coordination and support from your team

and market, enabling you to achieve more doing less.

Transform Leadership Pains Into More Protected Leadership

Leadership Pain

Confused about why things aren't working

Being defensive

Feeling fatigued, stressed & tired

External and internal distractions

Feeling a lack of support and looking over your shoulder all the time

New Maverick Leadership

Greater trust & belief in yourself

Seeing new possibilities to lead change

Abundant energy to do what is required

Clear focus on what moves the needle

Cohesive engaged team who have your back

How Much Is Your Leadership Vision & Tenure Worth?

How Much Is Your Leadership Vision & Tenure Worth?

Do you have a clear vision but not yet getting full support for it?

Are there delays, problems and obstacles impeding your vision causing it to take way more time, money and energy than expected?

Are you achieving your vision yet afraid that achievement, or you, will get diminished, corrupted or lost in the process or afterwards?

Are you worried about health issues, misfortune, key partnerships going sideways, your reputation being attacked or repercussions of past decisions showing up?

All these obstacles & concerns can be dramatically neutralized with greater awareness, protection & support.

To find out more how you can more easily fulfill your vision and maximize the value of your tenure by scheduling a Discovery Call here.

With sincere support & protection of you, your leadership & achievements,

Raamon

Determine Your CEO Protection Quotient (PQ)

Do you have a clear vision but not yet getting full support for it?

Are there delays, problems and obstacles impeding your vision causing it to take way more time, money and energy than expected?

Are you achieving your vision yet afraid that achievement, or you, will get diminished, corrupted or lost in the process or afterwards?

Are you worried about health issues, misfortune, key partnerships going sideways, your reputation being attacked or repercussions of past decisions showing up?

All these obstacles & concerns can be dramatically neutralized with greater awareness, protection & support.

To find out more how you can more easily fulfill your vision and maximize the value of your tenure by scheduling a Discovery Call here.

Talk soon and much protected progress in the mean time,

Raamon

Determine Your CEO Protection Quotient (PQ)

Our Charitable Non-Profit Purpose Supports Creating Permanent Peace, Protection & Prosperity for the World

Our Charitable Non-Profit Purpose Supports Creating Permanent Peace, Protection & Prosperity for the World

The primary role of a leader is to protect the progress of those they lead & the world.

This requires a leader t0 have both a high CEO leadership consciousness and a evolutionary purpose beyond just profit.

As former full-time meditating monks, combined total of 25 years, we know the power that full time meditating monks have in uplifting the quality of the world's collective consciousness so we created the:

This is the highest value

of applying our

Science of Protection on

a global scale.

Over 15% of our revenues go towards supporting monks around the world.

The primary role of a leader is to protect the progress

of those they lead and the world.

This requires a leader to have both a high CEO leadership consciousness

and a evolutionary purpose beyond just profit.

As former full-time meditating monks, combined total of 25 years, we know the power that full time meditating monks have in uplifting the quality of the world's collective consciousness so we created the:

This is the highest value of applying our

Science of Protection on a global scale.

Over 15% of our current revenues go towards supporting

monks creating peace around the world.

Copyright © Raam Global Consulting LLC, New Mavericks All Rights Reserved 2023

This site is not a part of the Facebook website or Facebook Inc.

Additionally, this site is NOT endorsed by Facebook in any way.

Facebook is a trademark of Facebook, Inc.